Individuals familiar with the progress of the Reg BI rulemaking say the rule is expected to be completed next year, potentially before a September 2019 final action date posted with the database of the Office of Information and Regulatory Affairs within the Office of Management and Budget.

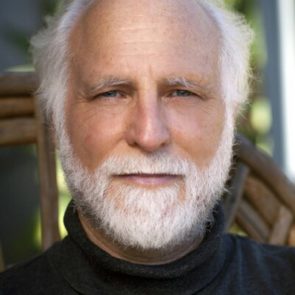

Testimony of Knut A. Rostad before the New Jersey Bureau of Securities

“Proposal Reg BI fails to explain best interest; however, it explains why conflicts can be beneficial” – Knut A. Rostad

Study Offers New Insights and Guidance for Reg BI

by Knut A. Rostad and Darren M. Fogarty — New insights into retail investor, financial reps misunderstandings of brokers and advisers.

Vanguard doesn’t get a free pass on this one

By Bob Veres, October 22, 2018 FinancialPlanning.com After Vanguard CEO Tim Buckley gave his startling keynote address at the Inside ETF’s conference in January (sole diamond sponsor: Vanguard), I received at least 30 email messages from advisors. Buckley’s words were certainly alarming: He said that Vanguard plans to attack financial planning and investment advice fees the […]

Leadership through Fiduciary Program

The Institute puts on a day-long program at the NAPFA Fall conference on the practices that differentiate fiduciary, fee-only advisors from sales brokers. Read more about the 2018 program here.

The SEC Isn’t Giving Us Straight Talk

If passed, the SEC’s 125,993-word proposed Reg Best Interest (“Reg BI”) will harm investors and greatly change the competitive landscape for brokers and advisors.