Financial Life Advisors 2338 N Loop 1604 W Suite 311 San Antonio, TX 78248 210.918.8998 advisor@fladvisors.com www.fladvisors.com Services Financial Life Advisors offers comprehensive wealth management and investment management and financial planning. Financial Life Advisors will work with clients remotely. Compensation methods accepted Assets Under Management (AUM) Hourly Fixed fee based on assets or financial circumstances. Required […]

Daylian Cain NYU Presentation

Yale business professor, Daylian Cain, is a prolific researcher on conflicts of interest. His notoriety in investment advice policy circles was further enhanced when the Obama administration cited his work in 2015, as it argued for the DOL Conflicts of Interest Rule.

In June 2016, Cain offered a quick (seven minute video) synopsis of his thinking. The video can be found here.

One key point in professor Cain’s synopsis highlighted in this one-page summary deserves special attention. It underscores why a policy of avoiding conflicts is far superior to a policy of accepting and disclosing conflicts. The point is the potential impact of conflicts on everyone. As Cain notes, “Yet, (its not just the bad apples)… normal people are also capable of really bad behavior.”

Investment Advisers Act 75th Anniversary – Statements from Industry Leaders and Experts

The Investment Adviser Association (IAA) asked a number of industry professionals, regulators, and other experts to share their views on the value the Investment Advisers Act has brought.

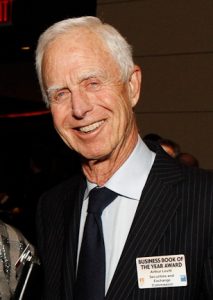

John Taft of SIFMA Explains Conduct Standards

Candid conversation with John Taft of SIFMA on conduct standards.

Professional and Personal Financial Planning

By Jeffrey W. McClure, CFP® — An excellent paper on the origins, meaning and importance of professions, and the status of financial planning as a profession.

Knut Rostad’s New Book Celebrates Bogle

ETF.com interviews Knut Rostad about his new book on John C. Bogle, “The Man in the Arena.”