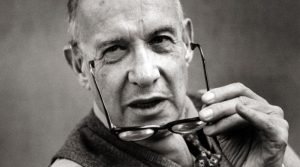

Last week the Institute for the Fiduciary Standard announced the first class of 27 Best Practices Advisors. Vanguard founder Jack Bogle and personal finance columnist and author Jane Bryant Quinn joined the Institute for a briefing in New York. A common question from journalists during and after the briefing was, ‘What’s new?’

Knut's Views

What DOL Fiduciary Victory Feels Like: The Texas Court Decision

Wednesday’s win in Texas federal court for the Labor Dept.’s fiduciary rule is important and deserves attention. Judge Barbara M. G. Lynn’s extensive review of the industry case against the DOL rule, the fiduciary standard and investors is an unequivocal investor victory.

How President Trump’s Conflicts Can Help RIAs

Mounds of research show most investors have no clue of the magnitude of the opaque BD compensation conflicts and what these conflicts cost them. Even Merrill Lynch’s John Thiel has publicly noted his customers don’t know what they pay.

The Merrill Lynch Mirage on RIAs

Where RIABiz’s view of RIAs as oases-of-ethics bumps up against the Merrill Lynch & Co. mirage — and why that mirage is still so effective.

In DOL/Post-DOL Fiduciary World, RIAs Need to Re-Differentiate

Tens of thousands of new fiduciary brokers will soon fly the fiduciary flag, as Merrill tells the country that the thundering herd will give all its customers – retirement and nonretirement accounts alike – ‘best interest’ treatment.

The October Surprise and Campaign for BICE

Will brokerage firms stick with commissions and service retirement accounts through the best interest contract exemption (BICE) or abandon commissions and offer “fee-based” retirement accounts?