SEC staff to issue two “Risk Alerts” for further guidance.

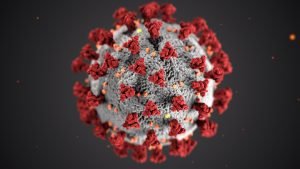

WealthManagement.com: Coronavirus Puts a Premium on Honest and Plain Talk from Advisors

Advisors who communicate quickly, openly and honestly … will come out in a stronger position.

The Virus We’re Not Containing

Conflicts of interest are a threat, but some regulators don’t seem to see the need to restrain them.

Personal Financial Planning Program Webinars

A note from Knut A. Rostad In September 2018, the Institute awarded the Frankel Fiduciary Prize to Harold Evensky at Texas Tech in Lubbock. While on campus I spoke before several classes and saw first hand the interest of students in the subject of fiduciary duties. Since then, in collaboration with two Personal Financial Planning […]

Protected: Institute for the Fiduciary Standard Form CRS Draft

There is no excerpt because this is a protected post.

Former CFP Board Chair Strikes Back

Knut Rostad interviewed Former CFPB Chair, Susan John, about CFPB’s recent decision to erase advisor compensation methods from its website.