If Gensler, who is uniquely well-suited for the task, becomes the SEC chairperson, it will harken back to the SEC’s origins.

Knut's Views

SEC Holiday Cheer for Investors

A year-end SEC order and statement by its staff on Reg BI exams are a positive signal for investors in need of fiduciary protection.

In Praise of Janet Yellen

Yellen checks many boxes – her scholarship, prior government experience and reputation in Washington.

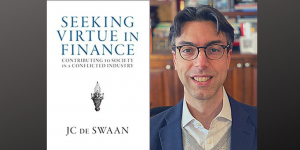

Students Worry About Being Corrupted on Wall Street

Knut Rostad summarizes his recent interview with Princeton lecturer JC de Swaan on virtue in finance.

Fiduciary Advice: Where Do We Go From Here?

An historic realignment of fiduciary advice has snuffed out 40 Act principles. The realignment reveals a path of destruction – to the law, language and logic.

Mourning the Passing of the 40 Act

The 40 Act has been effectively repealed. But its passing has gone unnoticed. In the long shadow of the market crash and severe depression, the 40 Act was the equivalent of investors’ civil rights legislation.