The Investment Adviser Association (IAA) asked a number of industry professionals, regulators, and other experts to share their views on the value the Investment Advisers Act has brought.

Research

Institute for the Fiduciary Standard/WealthManagement.com September 2015 DOL Conflict of Interest Survey

Institute for the Fiduciary Standard/WealthManagement.com September 2015 DOL Conflict of Interest Survey

Statement of Knut A. Rostad On “Best Interest” and SIFMA’s “Proposed Best Interest of the Customer Standard For Broker-Dealers”

The “Best Interest” standard is central to the regulation of advisers and brokers. It’s key to the DOL COI proposed rule and recent SEC statements and decisions. Now, a Securities Industry Financial and Markets Association (SIFMA) statement discusses conflicts of interest, disclosure and fee transparency. Despite its obvious importance, federal policy makers and regulators still have not affirmed or promulgated a view of the “Best Interest” standard as drawn from the Advisers Act and common law.

Conflicts of Interest and the Duty of Loyalty at the Securities & Exchange Commission

SEC Chair Mary Jo White’s recent statement that the SEC should proceed with rule-making on a uniform fiduciary standard focuses attention on what such a rule may entail.

Key Principles for Fiduciary Best Practices and an Emerging Profession

Fiduciary law is complex in its nuances and structures; fiduciary principles are not so complex. Instead they reflect the wisdom of Emerson, who noted, “Nothing is more simple than greatness; indeed, to be simple is to be great.” So it is with principles on which fiduciary best practices and an emerging advisory profession must rest. This paper notes the attributes of character, suggests relevant operating principles or premises for best practices based on these attributes, why these principles matter, and how they starkly differ from principles underlying common brokerage sales practices aggressively advocated by brokerage lobbyists. Throughout, the simplicity of these principles and their meaning to investors stand out.

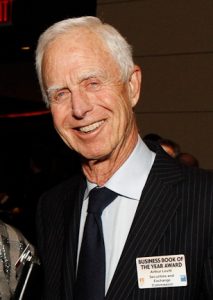

John Taft of SIFMA Explains Conduct Standards

Candid conversation with John Taft of SIFMA on conduct standards.