CFA Institute President and CEO, Paul Smith urges SEC to “regain control” of the fiduciary standard “by regulating the titles that those who provide personalized investment advice can use.”

Institute & Industry Leaders

Sheryl Garrett Endorses Institute for the Fiduciary Standard Best Practices Affirmation Program

Leader of hourly financial planning movement says Institute program provides much-needed clarity to help investors know what to expect from a fiduciary advisor

Fiduciary standards are important

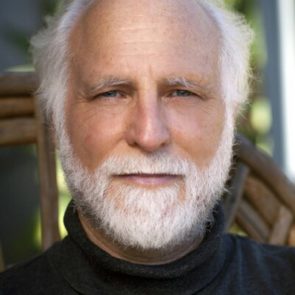

David will be among the first group of advisors of ‘Best Practices’ advisors the Institute will announce in March. Stay tuned.

Bob Veres: Where SIFMA and I Are In Total Agreement

The advisor world’s best-known advisor’s “advisor,” Bob Veres, has written extensively on how very different broker-dealers (sales persons) are from independent advisors.

Mercer Bullard: Think DOL’s Fiduciary Rule Is Too Strict? Blame SEC

The investor watchdog talks to ThinkAdvisor about why SEC Chair White is a ‘bad SEC chair for investors’ and why the Social Security trust fund isn’t as important as many think.

How Advisors Should Prepare for the DOL rule in the Trump Administration

There can be changes around the edges, or changes at the core, but I expect with certainty that there will be uncertainty for a while.