What’s ahead for 2018? There seems to be little basis to believe that the SEC will require financial advisers to act in the best interests of clients by requiring their advice (apart from any accompanying disclosure) to be unaffected by the adviser’s conflicts.

Blog

You’re on your own now

The Consumer Financial Protection Bureau has undergone a bit of a makeover. It’s no longer actually meant to regulate the financial services industry as it pertains to the treatment of Main Street – it has been transformed into an advocacy for the banks, credit card issuers, insurance companies, mortgage originators and brokerage firms against what it sees as overzealous regulation and job-killing oversight.

Tamar Frankel to Receive Ruth Bader Ginsburg Lifetime Achievement Award

Professor of Law and Michaels Faculty Research Scholar Tamar Frankel has been selected to receive the Ruth Bader Ginsburg Lifetime Achievement Award from the American Association of Law School’s (AALS) Section on Women in Legal Education.

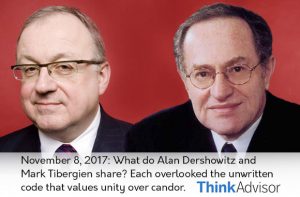

Mark Tibergien’s Comments on RIAs Are Tough, but Deserve to Be Heard

Mark Tibergien, the Pershing Advisor Solutions CEO, is sure to upset many RIAs, as his comments on RIAs suggest in an Oct. 18 discussion I had with him.

“Money is the new sex, the thing people don’t talk about.”

Mark Tibergien, CEO, Pershing Advisor Solutions, has been a thought leader in the business of advice for 30 years. Investment Advisor readers voted Tibergien the most influential leader in the advisory space earlier this year. Speaking with Knut Rostad, Tibergien expresses views that RIAs usually discuss privately. Examples? RIA standards are too low. The RIA voice is fragmented and brand is unclear. Tibergien also notes consumer distrust harms RIA recruitment and growth. To cap off, “Money is the new sex, the thing people don’t talk about.” A Freudian slip? Read on.

Why You Can’t Be “Three-Quarters of a Fiduciary”

Former SEC Commissioner Luis Aguilar spoke these words in 2010 when Dodd-Frank was under construction in Congress: “While the scope of service may vary between clients, the standards of loyalty and care in providing that service should not. You simply cannot be three-quarters of a fiduciary.”